business-entrepreneurs

3 Areas to Empower Your Employees to Improve Their Financial Wellbeing.

PERSONAL WELLNESS

The choice to make a powerful declaration to live a life in alignment around their spending, saving, investing and giving decisions. These decisions will begin to align with their internal values and true purpose. Thus, resulting in freedom, fulfillment and joy.

Your access points:

1. Discover your true purpose for money and life.2. Align your life with your purpose.

3. Align your spending with your purpose.

4. Align your saving with your purpose.

5. Align your investing with your purpose.

6. Align your giving with your purpose.

FINANCIAL WELLNESS

You and your employees will have an opportunity to put Financial Wellness into action. Financial Wellness focuses on the overall relationship with money. We believe this encompasses all three key areas: Personal, Financial, and Portfolio Wellness. Improving employee financial wellness can favorably impact an organization’s bottom line.

Employees who are financially unhealthy are often stressed and distracted, affecting absenteeism, productivity, retirement, and healthcare costs. We provide employers with valuable insight into the financial health of employees and the ability to measure the results and impact of benefit and wellness programs.

Your access points:

1. Create your Emergency Fund Plan.

2. Create a Budget Plan.

3. Create a Debt Free Life plan.

4. Create a 3 to 6 months of living expense emergency fund plan.

5. Create your Retirement Investing Plan of 15% of income.

6. Create a Higher Education Plan.

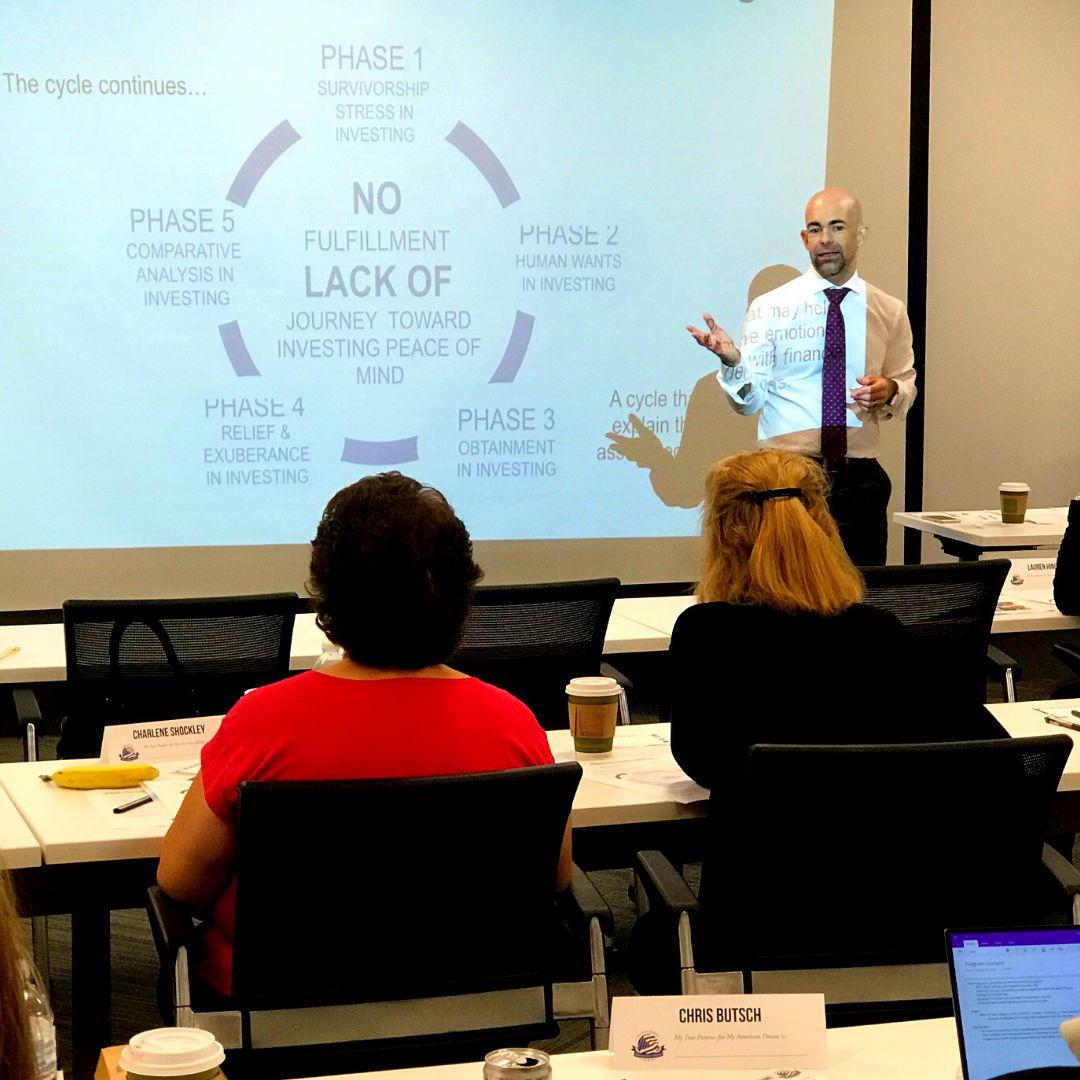

PORTFOLIO WELLNESS

We understand when changes to retirement plan benefits occur, employees are often confused and uncertain, which can ultimately affect employee morale and retention. We work with organizations and their employees to address their needs and questions before, during, and after the change occurs to help them make empowering educated choices.

Your access points:

1. Build a portfolio that avoids the common investing pitfalls.2. Build a portfolio that follows Nobel Prize winning academics.

3. Build a portfolio that has been empirically tested and has a history of success for real investors.

4. Build a portfolio designed to capture returns of the global markets.

5. Build a portfolio where the employee is not expected to be their own financial adviser, but has access to world class Investor Coaching.

6. Build a portfolio that aligns with your true purpose and is a pull for you to win and fulfill on that purpose.

Interested in learning more?