SmartPlan Blog

An Uncommon Solution to Fuel Your Resolutions and Goals

Welcome to Uncommon Sense, a podcast fostering real conversations about money. This podcast is designed specifically for eager investors who want to get real about money investing and winning at their dreams. I am Jennifer Foster, your host, a former administrative assistant turned American Dream Leader and Investing Strategy Coach. With over 17 years in the Financial Services industry, I have witnessed firsthand what worked, and sadly, what did not. I will go backstage each Wednesday - sometimes with friends, to have real, honest, and uncommon conversations about one of the most important and taboo topics money. My goal is to give you down to Earth episodes filled with uncommon sense so that you have an opportunity to discover something new. Be at the edge of your seat as we unleash the possibilities of transforming our thinking and actions so that we can gain confidence and win at our personal financial journey. So, let's begin this journey together.

With me today, I have Keith Stacy. Keith is one of the Investor Coaches out of our Jupiter office. Thanks for joining me today.

Keith: It is my pleasure.

Jen: So, it is funny. We have a lot of conversations and I am always telling you; I wish we recorded that. So today we are going to record it?

Keith: Maybe this will not be worthwhile right?

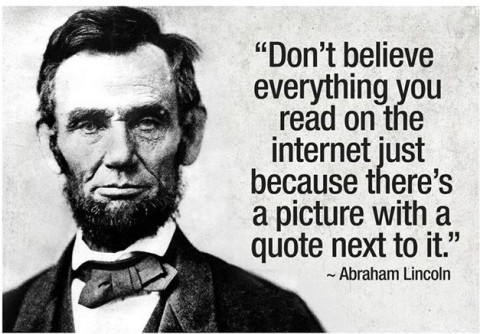

Jen: I think all our conversations have been worthwhile. I am just bummed we did not record them. We have plenty of time. We have 52 episodes for the new year. As I was preparing for this show I talked to you about how I had been listening to some other things on social media. And there were this group of women, their goal is to get a million women to a million dollars. They talk about money and finance. One this episode, they were talking about this 25/ 5 rule, which they said was some rule that Buffett made up. The rule is to write down 25 of your financial goals, circle the five top ones, and then forget about the rest. I wanted to do a little research into this, and I Googled and found some articles, and it turns out that Buffett never came up with this rule.

Keith: Figures. There is a quote on the Internet I saw once that said, "Can't believe everything you see on the Internet." And it was attributed to Abraham Lincoln.

So, it does sometimes help to do your due diligence, and it's funny because in this article they were stating 25/5 rules for "career goals." The ladies on the show were saying "financial goals." This is not what this article said, "career goals".

Keith: But in the end, it is not even Buffet's rule.

Jen: But I still thought it was kind of fun. I reached out and said, why don't we do this? Why don't we try to come up with 25 goals?

25/5 Goals for 2021

It was fun, I maxed out at, like, 19, and then the next six were a lot more difficult to come up with. It stretched my imagination. So, I am glad I did it.

Jen:I have found it to be a little bit difficult as well. I think I am a little bit behind. I am on number 17.

Keith: Wow Okay. Yeah, you did not even do the homework that you required me to do.

Jen: Well, I am doing it. You know as we get to this conversation, we will probably discover why this is a little bit harder to complete.

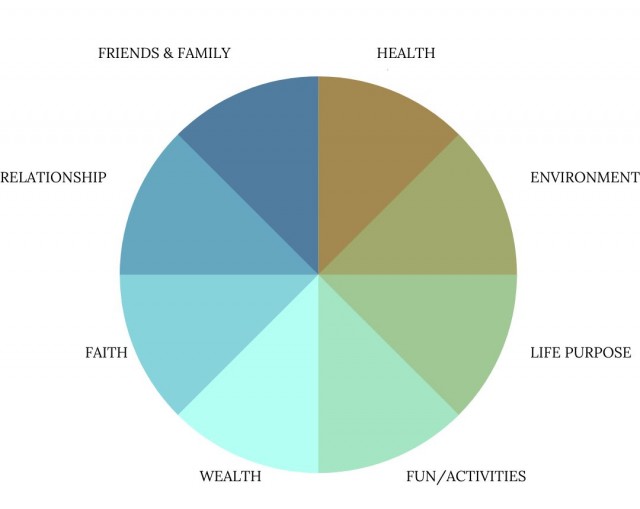

There are all different kinds of ways you can set up goals. I have heard: Wealth, Health, and Happiness as categories and pretty much any goals that you establish could go into one of those. There are a lot of different systems.

I thought it would be fun, why don't you tell me some of the goals that did not make it into your top five.

asparagus or something. So, I could be better about including vegetables in all my meals. But if I really look at all 25 goals, that is not the highest priority.

Jen:Yeah, well, you could always add a salad with your meal.

Keith: That is true, but that is more work and that defeats the purpose of doing a one-pot recipe.

Jen: You could get the salad in the bag. It is quick and easy, too.

Keith: I also put goal twenty-four- learn to snorkel, and I totally borrowed that from you, Jennifer, right?

Jen: We are going to do that before too long because we are getting ready to go out in a few weeks, and our friend is going to teach us.

Keith: Yeah, I am excited about that.

Jen: I love how you talked about adding vegetables to your meals as a goal. Because one of the goals that did not make it into my top five is to grow my own vegetables and my herbs. And while I may start it, I do not think that I am going to put too much time and effort into it just yet. If I do, I will give you some vegetables.

What goals did make it into your top five?

Jen: I have not really picked because I was still working on my list. I have not really picked my top five. I do know since I was looking over my finances and I noticed that during the pandemic my spending got a little out of hand. Us women can get a little crazy with Amazon.

Keith: And so, yeah, December does not really count right when you are trying to keep a budget.

Jen: Well, it is probably not even that bad in December as it probably was all throughout the pandemic. It's like, Oh, I needed this, and now I needed that. So, I have an Amazon card and it earns points. What I have decided is that any cashback that I get will only be used towards and purchases outside of my regular recurring purchases.

Jen: If I want something from Amazon, there needs to be enough in my cashback to make the purchase. That is one that will be on my top, and then the same thing with another card that has cashback. For that one, I am going to save that money for Christmas. I am going to put that in a separate account and save it for Christmas.

Jen: So those are two new goals for me? It is funny that we are talking about goals and I said, we might have a solution to help you powerfully fulfill them. What happens at the beginning of the year? A lot of people make resolutions or goals, and you know, the gyms are filled with people and everyone is going to get fit. And then what happens? They do not stick with it, right?

Jen: They may go for a little while, but then they get busy, lazy, or distracted and stop. We are talking about goals, but I do not like using goals. If we look at the definition of a goal, it is an ambition. Something you might put some effort towards or aim, the desired result.

Keith: It just sounds too wishy-washy. It is like, I might or might not. It is my goal you know, but who cares if I meet it or not? It would be nice, but you know.

Instead of goals, we use the term "commitments."

Keith: With commitments, the distinction is... Well, let me say it this way. An example we could use is marriage. Are you committed to staying faithful through thick or thin, or do you have the goal to stay faithful? If you said you had the goal to stay faithful your future spouse would be like... wait! What does that even mean, my goal is to be faithful that is not very assuring. However, if you are committed, then there is just a different English connotation or meaning.

Keith: For instance, one goal that is on my 25/5 list for 2021 was my goal from last year. It was run thrice a week -thrice is three times for the people that are uninitiated. And I didn't really do that much. I mean, I did. I ran probably about twice a week on average. There were certainly weeks where I did run three times. Certainly, weeks where I ran four times. There are also weeks where I ran once or not at all. It was just a goal- it was not a commitment. If I was truly committed to doing that, then I would have just decided. Okay, it is going to be nonnegotiable right?

What would I have to do for me to run three times a week? That means I must choose when I will run-say in the morning. And if I want to run in the mornings, that means I must do things differently than before. Perhaps I need to wake up earlier and go to bed earlier the night before. I could also layout my running close to making it as easy for me. If something is truly a commitment, I am going to schedule time, I am going to go out of my way to do it. It is going to be nonnegotiable, whereas goals too often are negotiable. And are something that would merely be nice to do.

You may even prioritize them in your own schedule.

Jen: I love that because a couple of years ago I went to this course and it was all about commitments. And they covered various areas. And they are like, what are you committed to in these areas? Better yet, who are you committed to "being?" I was basically writing down a checklist of goals in the various areas. And it was so funny. We came back the next week and the leader asked, how did you do with your commitments? And I had, I am committed to, eating healthy and exercising. And then, I look, did I eat healthily and exercise? No, so what did I do? I ate chicken wings, I watched TV. What was I really committed to? It was a real eye-opening exercise for me then. Throughout that course, and some others I wanted to be committed to this goal, but I was not.

Finally, as I was working on my 2020 statement, I declared my commitment. At SmartPlan Investing, we write out our annual statement. Standing in January of the next year, state what we accomplished in various areas of our life. I had committed to losing 60lbs in 2020. I had to look at what it was going to take to be my commitment. Just like you said about running, you must look, you cannot just make it a wish you have to plan it out. How are you going to make this happen? Here I am now having lost over 60lbs because I finally took those steps to be in, integrity to my commitment. When we talk about integrity is not, good, or bad, or right or wrong. Integrity is just what works and what does not. And me being overweight was not working.

Our UnCommon Cent$ tip for this episode is really looking at your New Year's resolutions and your goals and making them commitments. Be your word around the things that you say you are going to do or not do and plan for ways that you will accomplish them.

What is it going to take?

- Write down your commitments.

- Write down the steps that you need to take.

- Have a "by when" or due date.

- Schedule time in your calendar.

- Review it daily.

- Share your commitment with others.

Keith: I use my calendar on my phone. It is nice because you schedule things hour by hour. It is a good way to be productive and stay focused on your most important tasks. If someone asks me if I am available, I can easily see if I have already made a prior commitment.

Jen: Some people like to follow the S.M.A.R.T goals system: Specifics, Measurable, Attainable, Relevant, and Time-Based. One thing that is important is the "by when" date. By then, will you achieve or complete your commitment? Time blocking is important, you have specifically scheduled time for you to focus on your commitments. You must be intentional, it will not just happen by chance, it happens by design.

I have a complimentary Weekly Commitment Guide that you could download by visiting us online at www.Uncommon-Cents.com

On the guide, you can write out your commitments each week. Add your "by when date" and "your next steps". There are a few other helpful categories on the guide. This is a helpful tool to get you started. There are so many different systems out there. We just encourage you to use what works for you. Here are some areas you can look to create your commitments.If you decide to do this exercise, we want to hear how it is working out. Email us at

Catch up on past episodes on Apple podcast, Spotify, and iHeart Radio or on the web by clicking here.

You can follow me on Instagram at @RichChickJen

Join the UnCommon Cent$ Facebook group here.Do you have questions about your financial picture?

Let's talk about it.

Interested in learning more?